Edit Content

Welcome to FabTrader Community!

Get in touch with me

hello@fabtrader.in

hello@fabtrader.in

A Practical Guide to Navigating the Path from Solvency to Financial Abundance

“Back when I started my F.I.R.E. journey nine years ago, I had one burning question: Where do I begin, and how do I track this?“

At the time, there was no clear roadmap. I had to piece everything together from blog posts, podcasts, Reddit threads, and countless personal finance books. It often felt overwhelming — like trying to assemble a puzzle without knowing what the final picture looked like.

I remember the uncertainty.

The second-guessing.

The fear of making a wrong move.

But I also remember the drive — the deep desire to build a life of freedom, autonomy, and purpose.

Today, I’m grateful to say that I’ve reached Financial Independence. And the journey transformed me — not just financially, but mentally and emotionally. But lately, I’ve noticed something: whenever I meet members of our community who are walking this same path, I hear the same question I once had:

“Where do I start? And how do I know if I’m making progress?”

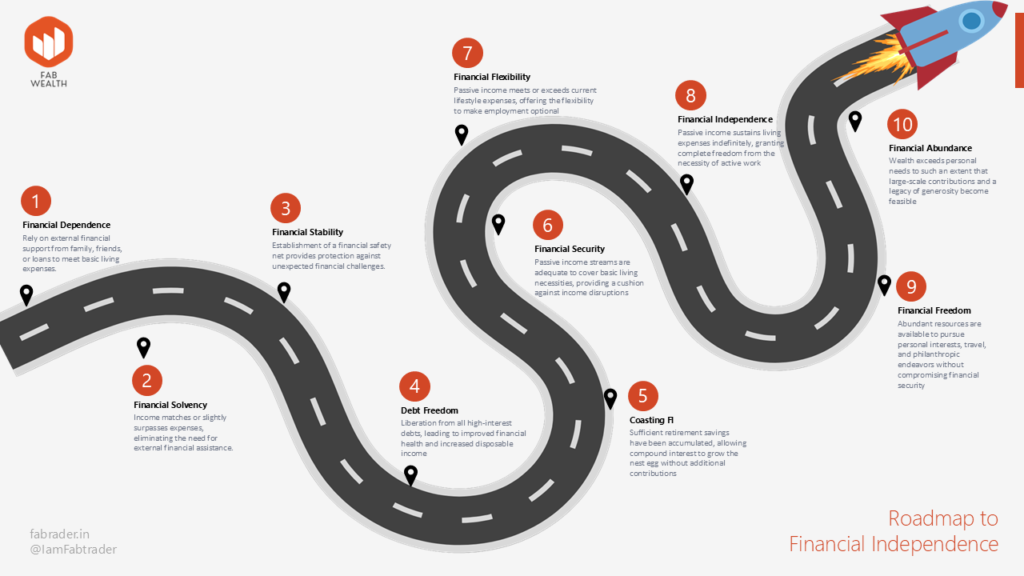

That’s why I created this article. Not just to explain the 10 stages of F.I.R.E., but to give you a clear, structured roadmap — the kind I wish I had back then. And to make it easier, I’ve also built a simple interactive tool that helps you assess where you are in your journey and what steps lie ahead.

If you’re feeling lost, uncertain, or overwhelmed — I’ve been there. And this guide is for you.

Let’s walk this journey together.

The traditional financial world gives vague advice:

“Save more, spend less, invest long-term”

But it doesn’t tell you where you stand today or how far you’ve come. That’s why so many people feel stuck, even when they’re doing the “right things.”

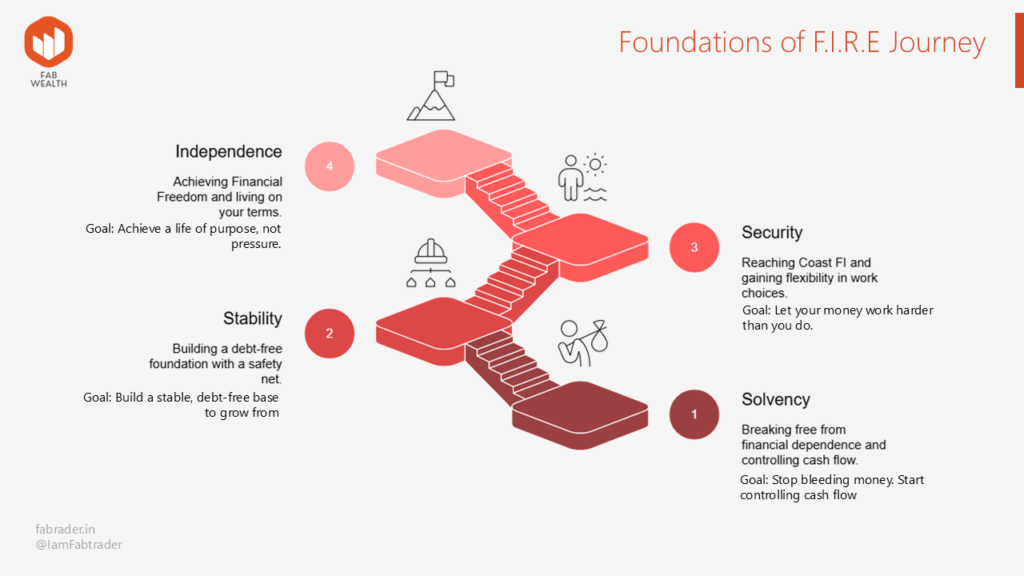

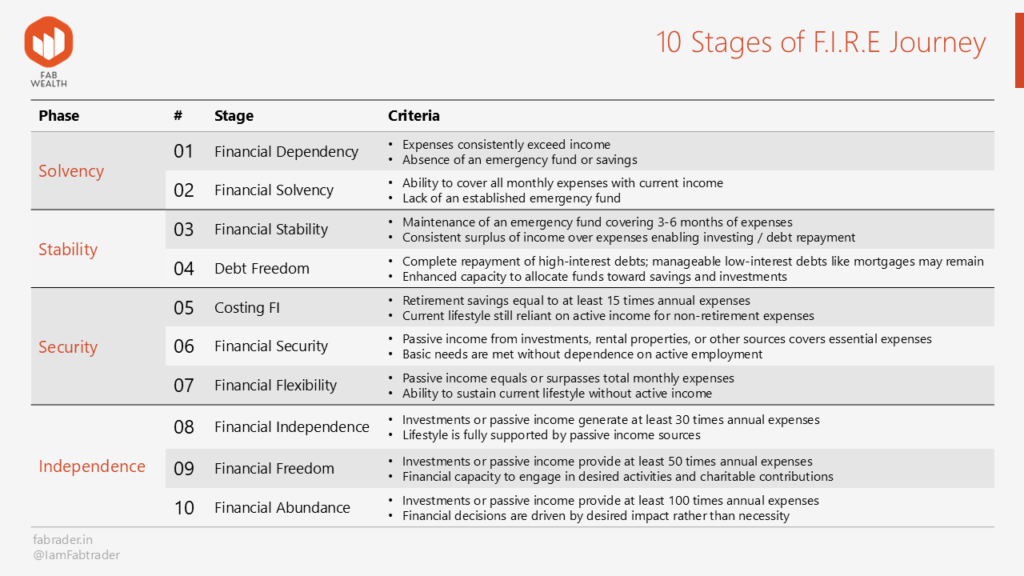

At FabTrader, we’ve developed a 10-Stage F.I.R.E. Framework grouped into 4 Phases — what we call:

This framework helps you:

Let’s explore these phases and what they mean for your financial life.

You rely on others (parents, partner, loans, or EMIs) to meet your basic expenses. You’re in survival mode

You earn enough to cover your own essential living expenses. You’ve stopped relying on credit to survive.

✅ What to Do in This Phase:

You have a 3–6 month emergency fund and can handle small life shocks without panic.

You’ve paid off all bad debt (especially credit cards, personal loans, or car EMIs).

✅ What to Do in This Phase:

You’ve invested enough that, even if you never save again, your corpus will grow (compounding) to your retirement target by normal retirement age

Passive income covers your basic/essential expenses. You have income resilience.

You can cover your total lifestyle expenses through a mix of passive income and flexible work. You can take career breaks or shift gears

✅ What to Do in This Phase:

Your passive income or investment returns can fully cover all your lifestyle expenses indefinitely. Work becomes optional

You’ve upgraded your life. You can travel, give, create, or experiment—without financial stress

You have more than enough. You’re in a position to create impact—through generosity, legacy, and purpose

✅ What to Do in This Phase:

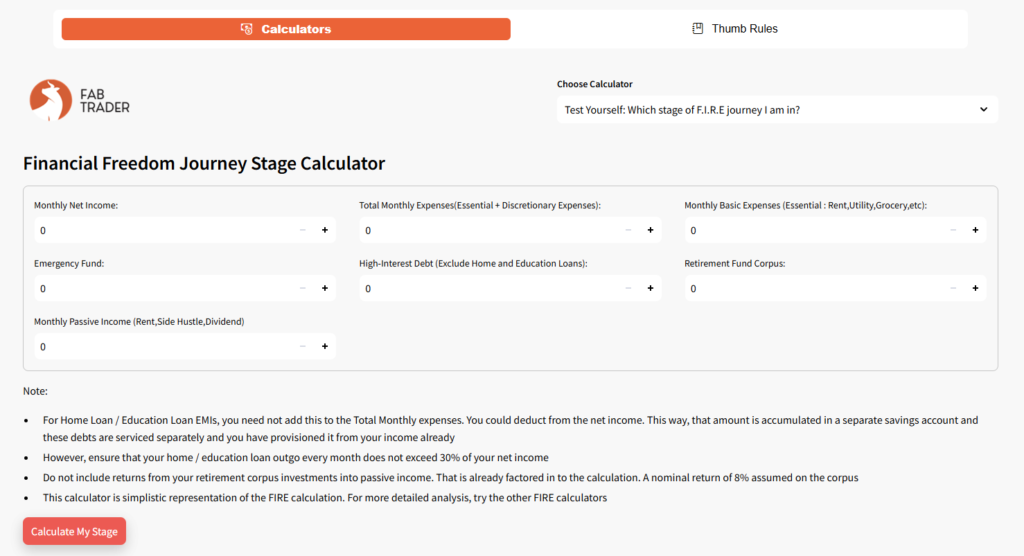

I’ve created a free online tool that takes just 3–5 minutes and tells you exactly:

Access this Tool HERE

For a more structured understanding, I’ve also created a downloadable presentation deck featuring:

DOWNLOAD THIS HANDBOOK HERE

The journey to Financial Independence is deeply personal. For some, it’s about escaping the rat race. For others, it’s about freedom to create, rest, or give. What unites all F.I.R.E. seekers is the desire for intentional living.

📌 Remember:

You don’t have to sprint. But you do need to know the direction. With the F.I.R.E. Ascent Framework, our online stage tracker, and your personal discipline, you’ll climb faster and more confidently.

Support this community : FabTrader.in is a one-person initiative dedicated to helping individuals on their F.I.R.E. journey. Running and maintaining this community takes time, effort, and resources. If you’ve found value in the content, consider making a donation to support this mission.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.

Vivek is an algorithmic trader, Python programmer, and a passionate advocate of the F.I.R.E. (Financial Independence, Retire Early) movement. He achieved his financial independence at the age of 45 and is dedicated to helping others embark on their own journeys toward financial freedom.

©2024 Fabtrader.in - An unit of Rough Sketch Company. All Rights Reserved