Edit Content

Welcome to FabTrader Community!

Get in touch with me

hello@fabtrader.in

hello@fabtrader.in

Intraday trading strategies come and go, but only a few stand the test of time. One such strategy is the Zero Loss Intraday Strategy proposed by Mahesh Chander Kaushik, a well-known YouTuber renowned for his simple yet effective trading methods. I recently created a YouTube video backtesting this strategy using Python, and in this article, I’ll walk you through its rules, the backtesting results, and whether it holds up in the real market

A key aspect of this strategy is the calculation of the Pivot Price, which is determined at 11 AM each trading day using the formula:

Pivot Price Point = ( Yesterday’s Day Close + Today’s Intraday High + Today’s Intraday Low) / 3

At 11 AM:

If the target is not met intraday, take delivery of the stock for a longer-term hold.

The target is an intraday gain of 0.7% (excluding brokerage and fees).

No stop-loss is placed.

# ------------------------------------------------------------------------------------

# FabTrader Algorithmic Backtesting

# ------------------------------------------------------------------------------------

# Copyright (c) 2022 FabTrader (Unit of Rough Sketch Company)

#

# LICENSE: PROPRIETARY SOFTWARE

# - This software is the exclusive property of FabTrader.

# - Unauthorized copying, modification, distribution, or use is strictly prohibited.

# - Written permission from the author is required for any use beyond personal,

# non-commercial purposes.

#

# CONTACT:

# - Website: https://fabtrader.in

# - Email: fabtraderinc@gmail.com

#

# Usage: Internal use only. Not for commercial redistribution.

# Permissions and licensing inquiries should be directed to the contact email.

import pandas as pd

import datetime as dt

import BrokerConnector

from Symbol_master import Instruments

class ZeroLossStrategyBacktest:

def __init__(self, stocks, start_date, end_date, use_stoploss=True, target_pct=0.0075,

max_investment=10000, starting_portfolio_value=100000):

self.stocks = stocks

self.start_date = start_date

self.end_date = end_date

self.use_stoploss = use_stoploss

self.target_pct = target_pct

self.max_investment = max_investment

self.portfolio_value = starting_portfolio_value

self.trade_log = []

def get_previous_trading_day_close(self, stock, current_date):

"""Find the previous valid trading day’s closing price."""

# >> Replace this code with your own function to retrieve historic candlestick data << #

daily_data = Instruments.get_historical_data(stock, self.start_date, self.end_date)

# >> Replace this code with your own function to retrieve historic candlestick data << #

daily_data = daily_data.sort_index()

previous_dates = daily_data.index[daily_data.index < current_date]

if len(previous_dates) > 0:

prev_day = previous_dates[-1]

return daily_data.loc[prev_day]["Close"]

return None

def get_high_low_for_the_day(self, stock, current_date):

"""Get high & low from 5-minute data before 11 AM."""

curr_date = current_date.date()

# >> Replace this code with your own function to retrieve historic candlestick data << #

intraday_data = Instruments.get_historical_data(stock, curr_date, curr_date, "5minute")

# >> Replace this code with your own function to retrieve historic candlestick data << #

if intraday_data.empty:

return None, None, None, None

intraday_data_before_11am = intraday_data[intraday_data.index.time < pd.Timestamp("11:00").time()]

if intraday_data_before_11am.empty:

return None, None, None, None

intraday_data_after_11am = intraday_data[intraday_data.index.time >= pd.Timestamp("11:00").time()]

if intraday_data_after_11am.empty:

return None, None, None, None

return (intraday_data_before_11am["High"].max(), intraday_data_before_11am["Low"].min(),

intraday_data_after_11am["High"].max(), intraday_data_after_11am["Low"].min(),

intraday_data_after_11am.iloc[0]['Close'], intraday_data_after_11am.iloc[-1]['Close'])

def backtest(self):

"""Runs the backtest for positional trades."""

for stock in self.stocks:

print(f"Backtesting {stock}...")

# >> Replace this code with your own function to retrieve historic candlestick data << #

data = Instruments.get_historical_data(stock, self.start_date, self.end_date)

# >> Replace this code with your own function to retrieve historic candlestick data << #

data.to_csv(stock+'.csv')

if data.empty:

continue

data = data.sort_index()

for date, row in data.iterrows():

prev_close = self.get_previous_trading_day_close(stock, pd.Timestamp(date))

if prev_close is None:

continue

high_before_11am, low_before_11am, high_after_11am, low_after_11am, close_at_11am, close_at_eod = (

self.get_high_low_for_the_day(stock, date))

if high_before_11am is None or low_before_11am is None:

continue

pivot_level = (prev_close + high_before_11am + low_before_11am) / 3

if close_at_11am >= pivot_level: # Bullish Zone. Long Trade

qty = self.max_investment // close_at_11am

target = close_at_11am * (1 + self.target_pct)

if target <= high_after_11am:

# Target hit intraday

pnl = (target - close_at_11am) * qty

pnl_percentage = (pnl * 100) / (close_at_11am * qty)

brokerage = 10 + (target * qty) * 0.0012

net_pnl = pnl - brokerage

net_pnl_percentage = (net_pnl * 100) / (close_at_11am * qty)

self.trade_log.append({

"tradingSymbol": stock,

"tradeState": "completed",

"entry_date": date,

"direction": "Long",

"qty": qty,

"entry": close_at_11am,

"exit": 0.0,

"Target": target,

"StopLoss": low_before_11am,

"exit_date": date.date(),

"pnl": pnl,

"pnl%": pnl_percentage,

"brokerage": brokerage,

"netPnl": net_pnl,

"netPnl%": net_pnl_percentage,

"Trade Status": "Target Hit"

})

self.portfolio_value += net_pnl

else:

# Trades that were not closed the same day will be carried over

self.trade_log.append({

"tradingSymbol": stock,

"tradeState": "active",

"entry_date": date,

"direction": "Long",

"qty": qty,

"entry": close_at_11am,

"Target": target,

"StopLoss": 0.0,

'exit_date': None,

'exit': 0.0,

"pnl": 0,

"pnl%": 0,

"brokerage": 0.0,

"netPnl": 0.0,

"netPnl%": 0.0,

"Trade Status": "Open"

})

elif close_at_11am <= pivot_level: # Bearish Zone. Short Trade

qty = self.max_investment // close_at_11am

target = close_at_11am * (1 - self.target_pct)

sl = high_before_11am

if target >= low_after_11am:

# Target hit intraday

pnl = (close_at_11am - target) * qty

pnl_percentage = (pnl * 100) / (close_at_11am * qty)

brokerage = 10 + (target * qty) * 0.0012

net_pnl = pnl - brokerage

net_pnl_percentage = (net_pnl * 100) / (close_at_11am * qty)

self.trade_log.append({

"tradingSymbol": stock,

"tradeState": "completed",

"entry_date": date,

"direction": "Short",

"qty": qty,

"entry": close_at_11am,

"exit": sl,

"Target": target,

"StopLoss": low_before_11am,

"exit_date": date.date(),

"pnl": pnl,

"pnl%": pnl_percentage,

"brokerage": brokerage,

"netPnl": net_pnl,

"netPnl%": net_pnl_percentage,

"Trade Status": "Target Hit"

})

# self.portfolio_value += (target - pivot_level) * qty

self.portfolio_value += net_pnl

elif sl <= high_after_11am:

# SL Hit Intraday

pnl = (close_at_11am - sl) * qty

pnl_percentage = (pnl * 100) / (close_at_11am * qty)

brokerage = 10 + (sl * qty) * 0.0012

net_pnl = pnl - brokerage

net_pnl_percentage = (net_pnl * 100) / (close_at_11am * qty)

self.trade_log.append({

"tradingSymbol": stock,

"tradeState": "completed",

"entry_date": date,

"direction": "Short",

"qty": qty,

"entry": close_at_11am,

"Target": target,

"StopLoss": low_before_11am,

'exit_date': date.date(),

'exit': sl,

"pnl": pnl,

"pnl%": pnl_percentage,

"brokerage": brokerage,

"netPnl": net_pnl,

"netPnl%": net_pnl_percentage,

"Trade Status": "SL Hit"

})

self.portfolio_value += net_pnl

else:

# For Short Trades, close the trade at EOD (profit or loss doesnt matter)

pnl = (close_at_11am - close_at_eod) * qty

pnl_percentage = (pnl * 100) / (close_at_11am * qty)

brokerage = 10 + (close_at_eod * qty) * 0.0012

net_pnl = pnl - brokerage

net_pnl_percentage = (net_pnl * 100) / (close_at_11am * qty)

self.trade_log.append({

"tradingSymbol": stock,

"tradeState": "completed",

"entry_date": date,

"direction": "Short",

"qty": qty,

"entry": close_at_11am,

"Target": target,

"StopLoss": high_before_11am,

'exit_date': date.date(),

'exit': close_at_eod,

"pnl": pnl,

"pnl%": pnl_percentage,

"brokerage": brokerage,

"netPnl": net_pnl,

"netPnl%": net_pnl_percentage,

"Trade Status": "Force Closed"

})

self.portfolio_value += net_pnl

# For all carried over trades, check if target achieved later in the testing cycle

for trade in self.trade_log:

for date, row in data.iterrows():

last_close_price = row['Close']

if trade['Trade Status'] != "Open":

continue

if date < trade['entry_date']:

continue

if row['High'] > trade['Target']:

pnl = (trade['Target'] - trade['entry']) * trade['qty']

pnl_percentage = (pnl * 100) / (trade['entry'] * trade['qty'])

brokerage = 10 + (trade['Target'] * trade['qty']) * 0.0012

net_pnl = pnl - brokerage

net_pnl_percentage = (net_pnl * 100) / (trade['entry'] * trade['qty'])

trade['exit'] = trade['Target']

trade['exit_date'] = date.date()

trade['pnl'] = pnl

trade['pnl%'] = pnl_percentage

trade["Trade Status"] = "Target Hit"

trade["brokerage"] = brokerage

trade['netPnl'] = net_pnl

trade['netPnl%'] = net_pnl_percentage

trade["tradeState"] = "completed"

self.portfolio_value += net_pnl

break

# Enable this code below to:

# Update latest price for all open trades so that notional profit/loss at the

# end of backtesting can be calculated. All open trades will be force closed and

# pnl will reflect the latest price at the end of the backtesting period

# for trade in self.trade_log:

# if trade['Trade Status'] != "Open":

# continue

#

# pnl = (last_close_price - trade['entry']) * trade['qty']

# pnl_percentage = (pnl * 100) / (trade['entry'] * trade['qty'])

# brokerage = 16 + (last_close_price * trade['qty']) * 0.0012

# net_pnl = pnl - brokerage

# net_pnl_percentage = (net_pnl * 100) / (trade['entry'] * trade['qty'])

#

# trade['exit'] = last_close_price

# trade['exit_date'] = end_date

# trade['pnl'] = pnl

# trade['pnl%'] = pnl_percentage

# trade["brokerage"] = brokerage

# trade['netPnl'] = net_pnl

# trade['netPnl%'] = net_pnl_percentage

# trade["Trade Status"] = "Force Closed"

# trade["tradeState"] = "completed"

# self.portfolio_value += net_pnl_percentage

# Per original strategy, stoploss is optional and is applicable only for intraday

# Enable this code below if you would like to extend this to the entire backtest period

# if self.use_stoploss:

# if date == trade['Buy Date']:

# if row['Low'] < trade['StopLoss']:

# pnl = (trade['StopLoss'] - trade['entry']) * trade['qty']

# pnl_percentage = (trade['StopLoss'] - trade['entry']) * trade['qty']

# brokerage = 16 + (trade['StopLoss'] * trade['qty']) * 0.0012

# net_pnl = pnl - brokerage

# net_pnl_percentage = (net_pnl * 100) / (trade['entry'] * trade['qty'])

# trade['exit'] = trade['StopLoss']

# trade['exit_date'] = date

# trade['pnl'] = pnl

# trade['pnl%'] = pnl_percentage

# trade["brokerage"] = brokerage

# trade['netPnl'] = net_pnl

# trade['netPnl%'] = net_pnl_percentage

# trade["Trade Status"] = "SL Hit"

# self.portfolio_value += net_pnl_percentage

# break

self.generate_report()

def generate_report(self):

"""Generate performance summary."""

trades_df = pd.DataFrame(self.trade_log)

trades_df.to_csv(r'./Results/pivotmckoutput.csv', index = None, header=True)

if trades_df.empty:

print("No trades executed.")

return

print("\nTrade Summary:")

total_trades = len(trades_df)

completed_df = trades_df[trades_df['tradeState'] == 'completed']

completed_trades = len(trades_df.loc[trades_df["tradeState"]=="completed"])

open_trades = len(trades_df.loc[trades_df["tradeState"]=="active"])

winning_trades = len(completed_df.loc[completed_df["netPnl"] > 0])

win_rate = winning_trades / completed_trades * 100

gross_pnl = completed_df["pnl"].sum()

total_brokerage = completed_df["brokerage"].sum()

total_pnl = completed_df["netPnl"].sum()

total_pnl_percent = completed_df["netPnl%"].sum()

print(f"\nPerformance Metrics:")

print(f"Total Trades: {total_trades}")

print(f"Total Completed Trades: {completed_trades}")

print(f"Total Open Trades: {open_trades}")

print(f"Total Winning Trades: {winning_trades}")

print(f"Win Rate: {win_rate:.0f}%")

print(f"Total Gross Pnl: {gross_pnl:.2f}")

print(f"Total Brokerage Paid : {total_brokerage:.2f}")

print(f"Total Net Pnl: {total_pnl:.2f}")

print(f"Starting Portfolio Balance %: {starting_portfolio:.2f}")

print(f"Ending Portfolio Value: {self.portfolio_value:.2f}")

self.trades_df = trades_df # Store results for analysis

if __name__ == "__main__":

#### Initial setup - Broker Connection ####

pd.set_option("display.max_rows", None, "display.max_columns", None)

#### Instrument Selection ####

stocks = ["INFY", "HDFCBANK", "RELIANCE", "TCS", "BHARTIARTL", "ICICIBANK", "SBIN", "HINDUNILVR", "ITC",

"BAJFINANCE"]

#### Backtesting Period ####

start_date = dt.date(2024, 1, 1) # Modify as needed

end_date = dt.date(2024, 3, 31) # Modify as needed

#### Backtest Starts ####

starting_portfolio = 100000

backtester = ZeroLossStrategyBacktest(

stocks=stocks,

start_date=start_date,

end_date=end_date,

use_stoploss=True, # Change to False to test without stop loss

starting_portfolio_value=starting_portfolio

)

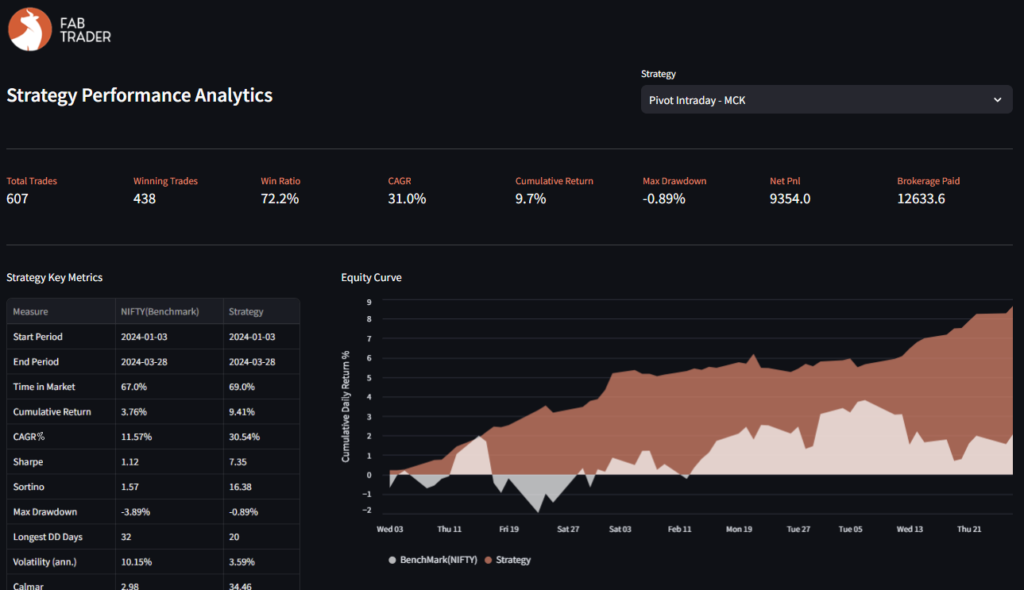

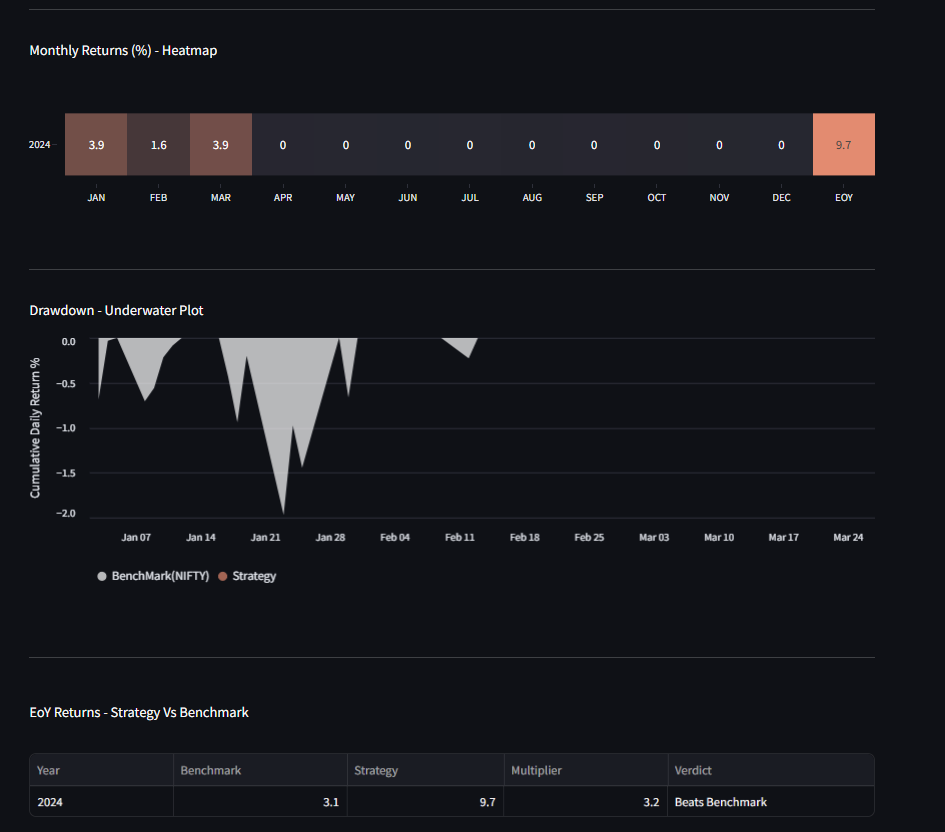

backtester.backtest()Using Python, I backtested this strategy on historical intraday data for the top 10 market cap stocks. The key findings were:

✔ Simple and easy-to-follow rules.

✔ No complicated indicators—just price action.

✔ Works well in a trending market.

✔ Suitable for traders with a long-term holding mindset.

❌ No defined stop-loss for long trades, which can be risky.

❌ Short trades require an existing profitable holding, limiting opportunities.

❌ Brokerage and slippages can eat into small profit margins.

Mahesh Chander Kaushik’s Zero Loss Intraday Strategy is a simple yet intriguing approach to trading, focusing on price levels rather than complex indicators. While it performs well in a steady market, traders should be cautious about its lack of a strict stop-loss mechanism and potential exposure to market downturns.

Would I personally use this strategy? With modifications! Adding a dynamic stop-loss and filtering trades based on volatility could improve overall performance.

Let me know your thoughts in the comments below, and don’t forget to check out my YouTube video where I explain the Python backtesting code and share detailed results!

Support this community : FabTrader.in is a one-person initiative dedicated to helping individuals on their F.I.R.E. journey. Running and maintaining this community takes time, effort, and resources. If you’ve found value in the content, consider making a donation to support this mission.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.

Vivek is an algorithmic trader, Python programmer, and a passionate advocate of the F.I.R.E. (Financial Independence, Retire Early) movement. He achieved his financial independence at the age of 45 and is dedicated to helping others embark on their own journeys toward financial freedom.

©2024 Fabtrader.in - An unit of Rough Sketch Company. All Rights Reserved