Edit Content

Welcome to FabTrader Community!

Get in touch with me

hello@fabtrader.in

hello@fabtrader.in

Investors are constantly looking for strategies that maximize returns while minimizing risk. One such strategy that has gained traction is the Trending Value Portfolio, a concept originally proposed by James O’Shaughnessy in his book What Works on Wall Street. This approach combines the best of momentum investing and value investing to identify stocks that are both fundamentally strong and currently trending upward in the market.

The Trending Value strategy relies on two critical aspects:

This refers to stocks that have shown strong price momentum over the last six months, attracting significant investor interest.

Stocks are sorted in descending order based on their six-month return performance.

The idea is to invest in stocks that are already gaining traction, ensuring that investors ride the wave of market interest.

These are stocks that are fundamentally strong but remain undervalued by the market.

The goal is to identify these hidden gems early, allowing investors to capitalize on their future growth potential.

Value investing traditionally focuses on stocks that have strong financials but are trading at a discount to their intrinsic value.

In this article, we will explore the technical workings of the Token method, explain how to implement it in Python, and discuss its advantages and limitations. We will also provide a Python script that automates the login process and demonstrates how to fetch user profile information using the encrypted token.

Historically, Momentum Investing and Value Investing were treated as independent strategies. However, O’Shaughnessy demonstrated that a synergy exists when combining them. The results from his backtesting showed:

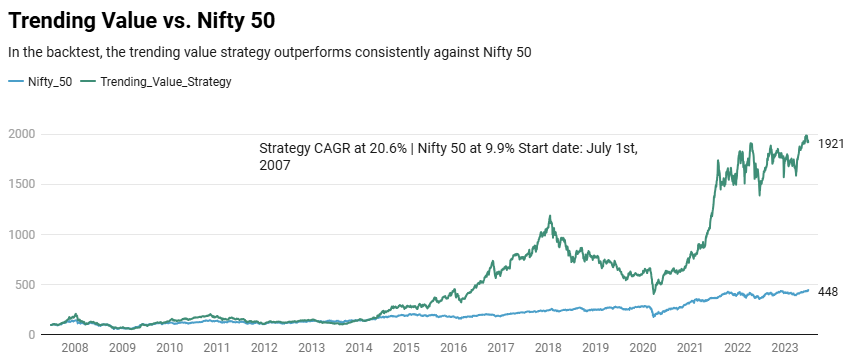

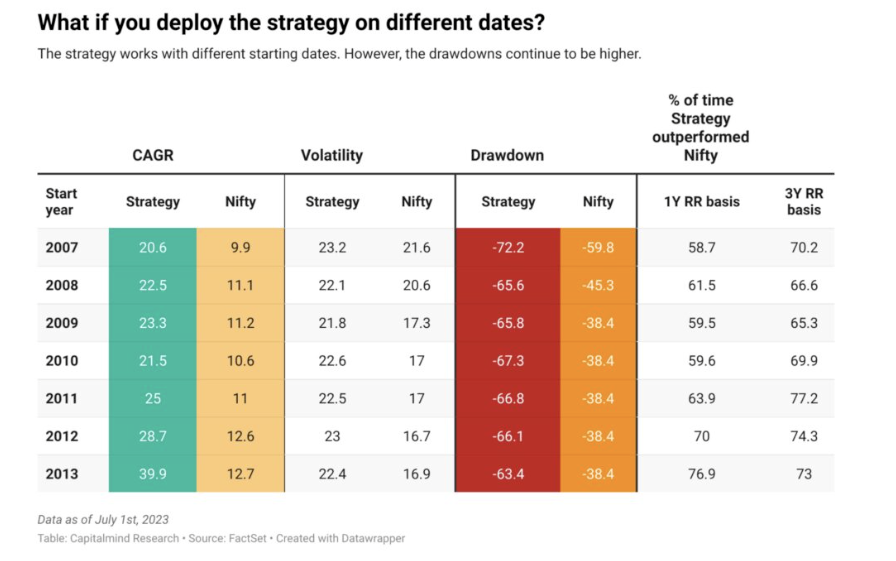

Our friends at Capitalminds have done an excellent job of breaking down this strategy and has done extensive back test on this. Refer to their article here

Shankar Nath, the popular youtuber has done his own set of back tests and has claimed that this strategy gave him a 96.9% return! Video

Courtesy : Capitalminds

To identify undervalued stocks, O’Shaughnessy introduced the Value Composite Score, which is calculated using six key financial metrics:

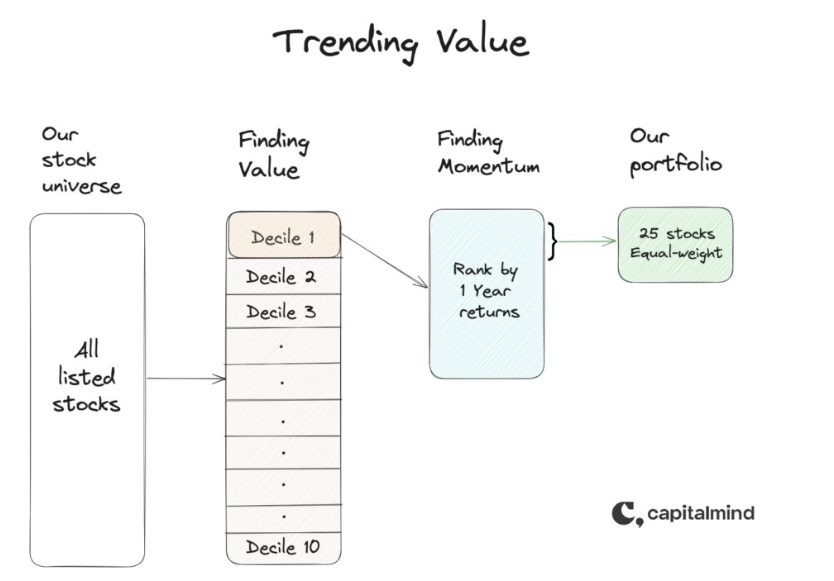

The Trending Value Portfolio focuses on stocks with a market capitalization of more than ₹500 crore. This ensures a good mix of small-cap and micro-cap stocks, which tend to offer high growth potential while maintaining reasonable liquidity.

Backtesting by O’Shaughnessy showed that a 25-stock portfolio provided the best risk-adjusted returns. A smaller portfolio increases volatility, while a larger one dilutes potential gains.

To maintain efficiency, the Trending Value Portfolio must be rebalanced either quarterly or semiannually. The process includes:

I have built this automated python screener that can fetch the 25 stocks per strategy rules with a single click of a button! Try this out and let me know if its useful

"""

Automated Screener for Fetching Trending Value stocks

Reference: Refer to Shankar Nath's Trending Value video for detaile rules

-- Dependencies to be installed --

pip install beautifulsoup4==4.11.2

pip install openpyxl

pip install pandas

Disclaimer:

The information provided is for educational and informational purposes only and

should not be construed as financial, investment, or legal advice. The content is based on publicly available

information and personal opinions and may not be suitable for all investors. Investing involves risks,

including the loss of principal.

Author: FabTrader (fabtraderinc@gmail.com)

www.fabtrader.in

YouTube: @fabtraderinc

X / Instagram / Telegram : @fabtraderinc

"""

import time

import pandas as pd

def fetchScreenerData(link):

cache_index = None

data = pd.DataFrame()

current_page = 1

page_limit = 25

while current_page < page_limit:

if current_page == 1:

url=link

else:

url = f'{link}?page={current_page}'

all_tables = pd.read_html(url, flavor='bs4')

combined_df = pd.concat(all_tables)

combined_df = combined_df.drop(

combined_df[combined_df['S.No.'].isnull()].index)

# print(combined_df)

# if cache_index == combined_df.iloc[-2]['S.No.']:

if len(combined_df.index) < 26:

data = pd.concat([data, combined_df], axis=0)

break

# cache_index = combined_df.iloc[-2]['S.No.']

# print(cache_index)

data = pd.concat([data, combined_df], axis=0)

current_page += 1

time.sleep(1)

data = data.iloc[0:].drop(data[data['S.No.'] == 'S.No.'].index)

return data

pd.set_option("display.max_rows", None, "display.max_columns", None)

print("Starting to extract data.....")

# Fetch PE/PB/Dividend Yield Value Ratio

pbv_link = 'https://www.screener.in/screens/2112737/trendvalue_pricebookvalue/'

pbv_df = fetchScreenerData(pbv_link)

pbv_df = pbv_df[['Name','P/E', 'Div Yld %', 'CMP / BV']]

pbv_df['P/E'] = pd.to_numeric(pbv_df['P/E'], errors='coerce')

pbv_df['Div Yld %'] = pd.to_numeric(pbv_df['Div Yld %'], errors='coerce')

pbv_df['CMP / BV'] = pd.to_numeric(pbv_df['CMP / BV'], errors='coerce')

pbv_df['P/E'] = pbv_df['P/E'].fillna(100000)

pbv_df['CMP / BV'] = pbv_df['CMP / BV'].fillna(100000)

pbv_df['Div Yld %'] = pbv_df['Div Yld %'].fillna(0)

pbv_df.to_excel('D:/pbv.xlsx', index=False)

pbv_df.dropna(inplace=True)

pbv_df = pbv_df[pbv_df['P/E'] > 0]

pbv_df = pbv_df[pbv_df['Div Yld %'] > 0]

merged_df = pbv_df

# Fetch Price to Free Cash Flow

cashflow_link = 'https://www.screener.in/screens/2112756/trendvalue_cashflow/'

cf_df = fetchScreenerData(cashflow_link)

cf_df = cf_df[['Name','CMP / OCF']]

cf_df['CMP / OCF'] = pd.to_numeric(cf_df['CMP / OCF'], errors='coerce')

cf_df['CMP / OCF'] = cf_df['CMP / OCF'].fillna(100000)

cf_df.to_excel('D:/cashflow.xlsx', index=False)

cf_df.dropna(inplace=True)

cf_df = cf_df[cf_df['CMP / OCF'] > 0]

merged_df = pd.merge(merged_df, cf_df, on='Name', how='inner')

print("Free Cash Flow data extraction complete")

# Fetch EV to EBITDA

ev_link = 'https://www.screener.in/screens/2112767/trendvalue_ev/'

ev_df = fetchScreenerData(ev_link)

ev_df = ev_df[['Name','EV / EBITDA']]

ev_df['EV / EBITDA'] = pd.to_numeric(ev_df['EV / EBITDA'], errors='coerce')

ev_df['EV / EBITDA'] = ev_df['EV / EBITDA'].fillna(100000)

ev_df.to_excel('D:/ev.xlsx', index=False)

ev_df.dropna(inplace=True)

ev_df = ev_df[ev_df['EV / EBITDA'] > 0]

merged_df = pd.merge(merged_df, ev_df, on='Name', how='inner')

print("EV to EBDITA data extraction complete")

# Fetch Price to Sales ratio

sales_link = 'https://www.screener.in/screens/2112772/trendvalue_pricesales/'

sales_df = fetchScreenerData(sales_link)

sales_df = sales_df[['Name','CMP / Sales']]

sales_df['CMP / Sales'] = pd.to_numeric(sales_df['CMP / Sales'], errors='coerce')

sales_df['CMP / Sales'] = sales_df['CMP / Sales'].fillna(100000)

sales_df.to_excel('D:/sales.xlsx', index=False)

sales_df.dropna(inplace=True)

sales_df = sales_df[sales_df['CMP / Sales'] > 0]

print("Price to Sales Ratio data extraction complete")

# Fetch Last 6 months return (Momentum)

momentum_link = 'https://www.screener.in/screens/2112742/trendvalue_momentum/'

mo_df = fetchScreenerData(momentum_link)

mo_df = mo_df[['Name','6mth return %']]

mo_df['6mth return %'] = pd.to_numeric(mo_df['6mth return %'], errors='coerce')

mo_df['6mth return %'] = mo_df['6mth return %'].fillna(-100000)

mo_df.to_excel('D:/mo.xlsx', index=False)

mo_df.dropna(inplace=True)

mo_df = mo_df[mo_df['6mth return %'] > 0]

merged_df = pd.merge(merged_df, mo_df, on='Name', how='inner')

print("Momentum / 6 month Returns data extraction complete")

# Final Merged dataset

merged_df = pd.merge(merged_df, sales_df, on='Name', how='inner')

merged_df.columns = ['Stock', 'PE', 'Div', 'BV', '6mo Return', 'Cashflow','EV', 'Sales']

merged_df['PE'] = merged_df['PE'].map(lambda x: float(x))

merged_df['Div'] = merged_df['Div'].map(lambda x: float(x))

merged_df['BV'] = merged_df['BV'].map(lambda x: float(x))

merged_df['6mo Return'] = merged_df['6mo Return'].map(lambda x: float(x))

# merged_df['3mo Return'] = merged_df['3mo Return'].map(lambda x: float(x))

merged_df['Cashflow'] = merged_df['Cashflow'].map(lambda x: float(x))

merged_df['EV'] = merged_df['EV'].map(lambda x: float(x))

merged_df['Sales'] = merged_df['Sales'].map(lambda x: float(x))

# Apply Decile for PE

merged_df['PE_Rank'] = merged_df['PE'].rank()

merged_df['PE_Decile'] = pd.qcut(merged_df['PE_Rank'], q=10, labels=False, duplicates='drop') + 1

# Apply Decile for Div

merged_df['Div_Rank'] = merged_df['Div'].rank(ascending=False)

merged_df['Div_Decile'] = pd.qcut(merged_df['Div_Rank'], q=10, labels=False, duplicates='drop') + 1

# Apply Decile for BV

merged_df['BV_Rank'] = merged_df['BV'].rank()

merged_df['BV_Decile'] = pd.qcut(merged_df['BV_Rank'], q=10, labels=False, duplicates='drop') + 1

# Apply Decile for Cashflow

merged_df['Cashflow_Rank'] = merged_df['Cashflow'].rank()

merged_df['Cashflow_Decile'] = pd.qcut(merged_df['Cashflow_Rank'], q=10, labels=False, duplicates='drop') + 1

# Apply Decile for EV

merged_df['EV_Rank'] = merged_df['EV'].rank()

merged_df['EV_Decile'] = pd.qcut(merged_df['EV_Rank'], q=10, labels=False, duplicates='drop') + 1

# Apply Decile for Sales

merged_df['Sales_Rank'] = merged_df['Sales'].rank()

merged_df['Sales_Decile'] = pd.qcut(merged_df['Sales_Rank'], q=10, labels=False, duplicates='drop') + 1

# Consolidated_Rank column

merged_df['Consolidated_Rank'] = merged_df['PE_Decile'] + merged_df['Div_Decile'] + merged_df['BV_Decile'] + merged_df['Cashflow_Decile'] + merged_df['EV_Decile'] + merged_df['Sales_Decile']

# Retain only stocks that has given a postive return in the last 6 months

merged_df = merged_df[merged_df['6mo Return'] > 0]

# Decile on consolidated rank

merged_df['Consolidated_Decile'] = pd.qcut(merged_df['Consolidated_Rank'], q=10, labels=False, duplicates='drop') + 1

merged_df = merged_df.sort_values(by=['Consolidated_Decile', '6mo Return'], ascending=[True, False])

merged_df.to_excel('D:/merged.xlsx', index=False)

# Retain only rows in the first decile of Consolidated_Decile

df_final = merged_df[merged_df['Consolidated_Decile'] == 1]

df_final = df_final.sort_values(by=['6mo Return'], ascending=False)

# df_final = df_final.head(25)

df_final.to_excel('D:/final.xlsx', index=False)

print("Final Dataset")

print(df_final)

The Trending Value Portfolio is a powerful strategy that leverages both market momentum and fundamental strength. By combining the best aspects of momentum investing (trending stocks) and value investing (undervalued stocks), this approach has historically outperformed traditional investment strategies.

For investors looking to enhance their portfolio returns while maintaining a disciplined, systematic approach, Trending Value Investing offers a proven, data-backed method to achieve superior gains.

Support this community : FabTrader.in is a one-person initiative dedicated to helping individuals on their F.I.R.E. journey. Running and maintaining this community takes time, effort, and resources. If you’ve found value in the content, consider making a donation to support this mission.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.

Vivek is an algorithmic trader, Python programmer, and a passionate advocate of the F.I.R.E. (Financial Independence, Retire Early) movement. He achieved his financial independence at the age of 45 and is dedicated to helping others embark on their own journeys toward financial freedom.

©2024 Fabtrader.in - An unit of Rough Sketch Company. All Rights Reserved