Edit Content

Welcome to FabTrader Community!

Get in touch with me

hello@fabtrader.in

hello@fabtrader.in

Have you ever noticed how stock prices sometimes start moving before any big news actually hits the market? Maybe a rally starts a week before earnings, or a sudden surge happens ahead of an expected announcement. What you’re seeing isn’t magic—it’s the footprint of smart money.

Retail traders often wait for the headlines. They react after the news is out. Smart money—like institutional investors, prop desk traders, and large funds—anticipates. They position themselves ahead of the curve. And one of the clearest examples of this is how they trade around corporate earnings results.

This post kicks off a 3-part series on a corporate results trading strategy I learned from a friend who works on the trading desk at a large global bank. In this first part, we’ll look at what happens before the results are even announced—a high-probability setup that retail traders almost always overlook.

Institutional desks don’t wait for the press release—they start accumulating their positions 10–15 days before the earnings announcement, once they sense that results are likely to be good. By the time the retail crowd starts buying after the results are out, smart money is already booking profits and getting out.

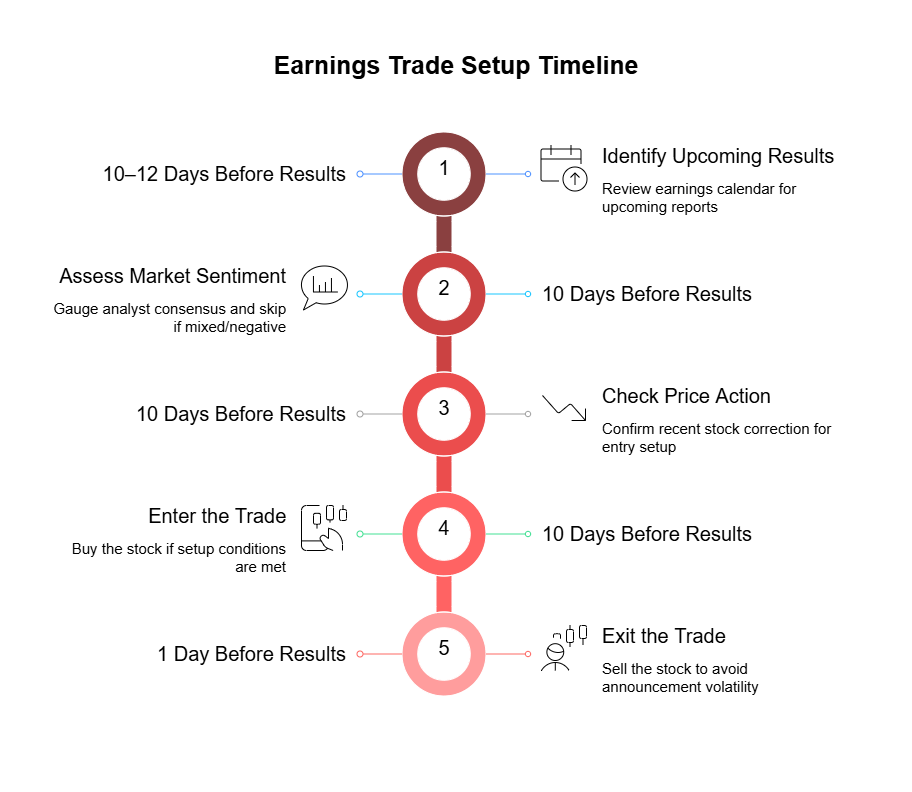

Here’s how this “Earnings Drift” strategy works, step by step:.

Start by reviewing the earnings calendar 10–12 days ahead. You can use platforms like:

Before you take any position, gauge the market’s mood toward the upcoming results:

⚠️ If the sentiment is mixed or negative, skip the trade. This setup only works when there is consensus that good results are expected.

The stock should have gone through a recent correction—meaning it must have pulled back in the days/weeks leading up to this 10-day mark.

If both sentiment and price action confirm the setup, buy the stock roughly 10 days before the expected results date.

This is crucial.

Once the results are out, price behavior becomes erratic and news-dependent. You’re no longer in control—avoid holding through the actual announcement.

Retail traders often get caught in the excitement after a good earnings report hits the market. They buy into the stock when it’s already rallied 10–15%—thinking it will keep going.

But what they don’t realize is that institutional players are likely exiting their positions at that very moment, locking in their profits. The post-result phase often sees a “sell-the-news” effect, where prices dip even after strong numbers are declared.

This divergence in behavior is what separates seasoned traders from the crowd.

Lesson: Don’t chase the headline. Anticipate the move.

Not all stocks are suited for this strategy. In fact, avoiding certain categories can significantly improve your win rate.

Government-owned entities are not performance-driven in the traditional sense. Their price action is often dictated by:

Hence, this earnings-based strategy is not effective for PSU stocks.

Commodity sector stocks (like metal, oil & gas, etc.) are heavily influenced by global price trends. Even if results are good, macro factors like crude prices or global demand can overshadow them. Skip these too.

Even if the stock keeps going up post-announcement, resist the urge to hold.

Stick to the system: Buy early, sell before the news.

Whether you’re a trader, investor, or market analyst, this dashboard is a powerful addition to your toolkit.

This pre-result strategy is a textbook example of how anticipation beats reaction in the markets. It’s how the smart money operates—quietly positioning ahead of time, letting the retail crowd fuel the final move, and then exiting gracefully before volatility takes over.

As a retail trader, the edge lies in understanding these patterns and playing alongside the big players—not chasing them.

Stay tuned for the next part in this series, where we’ll explore how to trade after the results, and another variation involving intraday plays around earnings volatility.

Watch this space!

Support this community : FabTrader.in is a one-person initiative dedicated to helping individuals on their F.I.R.E. journey. Running and maintaining this community takes time, effort, and resources. If you’ve found value in the content, consider making a donation to support this mission.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.

Vivek is an algorithmic trader, Python programmer, and a passionate advocate of the F.I.R.E. (Financial Independence, Retire Early) movement. He achieved his financial independence at the age of 45 and is dedicated to helping others embark on their own journeys toward financial freedom.

©2024 Fabtrader.in - An unit of Rough Sketch Company. All Rights Reserved