Edit Content

Welcome to FabTrader Community!

Get in touch with me

hello@fabtrader.in

hello@fabtrader.in

Corporate actions like Bonus Issues, Stock Splits, Dividends, and Buybacks play a crucial role in stock market movements. For traders, especially algo traders, having access to this data in a structured format can provide a strategic advantage.

In this article, I introduce a simple yet powerful Python utility that automates the extraction of corporate action data directly from the NSE (National Stock Exchange of India) website. If you’re an algorithmic trader looking to integrate this data into your trading models, this guide will help you get started.

Corporate actions significantly impact stock prices and market sentiment. Here’s why tracking them is essential:

For algo traders, integrating corporate action data into their models ensures backtesting accuracy, event-driven trading strategies, and better risk management.

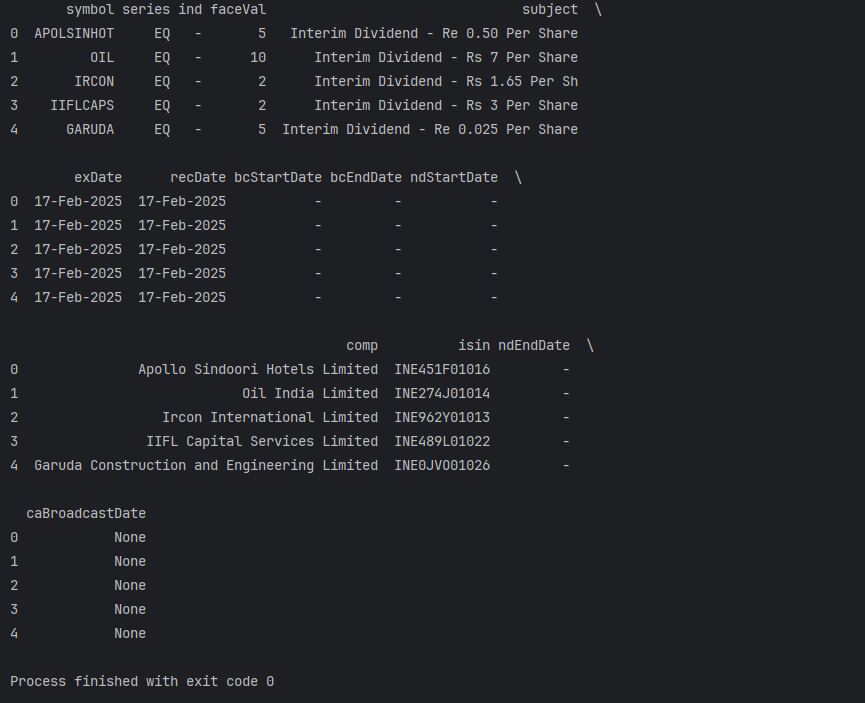

We have developed a Python utility that downloads corporate action data from the NSE and presents it in a structured pandas DataFrame. This allows for easy analysis and integration into trading algorithms.

The Python code of the full Utility (NseUtility) can be downloaded from the article >> HERE

Here’s how you can use the utility to fetch different types of corporate actions:

import NseUtility

# Create an instance of NSEUtility

nse = NseUtility.NseUtils()

# Fetch corporate actions for the last one month

print(nse.get_corporate_action().head())

# Fetch corporate actions for a specific date range

print(nse.get_corporate_action('01-01-2025', '31-01-2025').head())

# Fetch only Bonus data

print(nse.get_corporate_action('01-01-2025', '31-01-2025', "Bonus"))

# Fetch only Dividend data

print(nse.get_corporate_action('01-01-2025', '31-01-2025', "Dividend"))

# Fetch only Split data

print(nse.get_corporate_action('01-01-2025', '31-01-2025', "Split"))

# Fetch only Buyback data

print(nse.get_corporate_action('01-01-2025', '31-03-2025', "Buy Back"))

With algorithmic trading gaining traction, the need for high-quality, real-time corporate action data is more important than ever. This Python utility simplifies the process, enabling traders to fetch, analyze, and act on key stock market events effortlessly.

If you’re an algo trader, consider integrating this data into your trading models to stay ahead of the curve.

📌 Try it out and let me know how it enhances your trading strategies! 🚀

Support this community : FabTrader.in is a one-person initiative dedicated to helping individuals on their F.I.R.E. journey. Running and maintaining this community takes time, effort, and resources. If you’ve found value in the content, consider making a donation to support this mission.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.

Vivek is an algorithmic trader, Python programmer, and a passionate advocate of the F.I.R.E. (Financial Independence, Retire Early) movement. He achieved his financial independence at the age of 45 and is dedicated to helping others embark on their own journeys toward financial freedom.

©2024 Fabtrader.in - An unit of Rough Sketch Company. All Rights Reserved