Introduction

Asset allocation is one of the most crucial decisions for any investor. While there is extensive research on optimal asset allocation strategies in the US and other developed markets, limited studies have been conducted using real-time historical data from the Indian market. This article aims to provide insights into what could be an ideal asset allocation model for Indian investors based on historical performance, risk-adjusted returns, and overall feasibility.

Understanding the Role of Asset Allocation

Asset allocation is about balancing risk and return by diversifying investments across different asset classes. The goal is to create a portfolio that maximizes returns while minimizing drawdowns and volatility. However, the concept of an “ideal” asset allocation varies from investor to investor, depending on their risk tolerance, financial goals, and investment horizon.

An investor’s objective should be to allocate the minimum possible to risky assets while still achieving their required long-term return. This balance helps in reducing potential regret, which plays a significant role in an investor’s ability to stay committed to their investment strategy.

Examining Different Asset Allocation Models

To identify a feasible asset allocation strategy, we evaluate various portfolio combinations using historical data spanning 30 years from the Indian market. The four asset classes considered are:

- Domestic Equities (Indian Stock Market)

- Debt (Fixed-Income Instruments like Bonds, FDs, etc.)

- Gold (As a hedge against inflation and market downturns)

- US Equities (For global diversification and exposure to international markets)

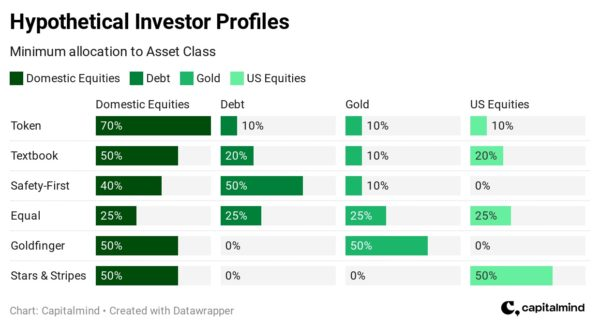

Hypothetical Asset Allocation Profiles

- Token: 70% Domestic Equities, 10% Debt, 10% Gold, 10% US Equities

- TextBook: 50% Domestic Equities, 20% Debt, 10% Gold, 20% US Equities

- Safety-First: 40% Domestic Equities, 50% Debt, 10% Gold, 0% US Equities

- Equal-Weight: 25% Domestic Equities, 25% Debt, 25% Gold, 25% US Equities

- Goldfinger: 50% Domestic Equities, 0% Debt, 50% Gold, 0% US Equities

- Stars & Stripes: 50% Domestic Equities, 0% Debt, 0% Gold, 50% US Equities

- Nifty-Only: 100% Domestic Equities, 0% Debt, 0% Gold, 0% US Equities

These profiles range from highly equity-concentrated strategies to well-diversified portfolios.

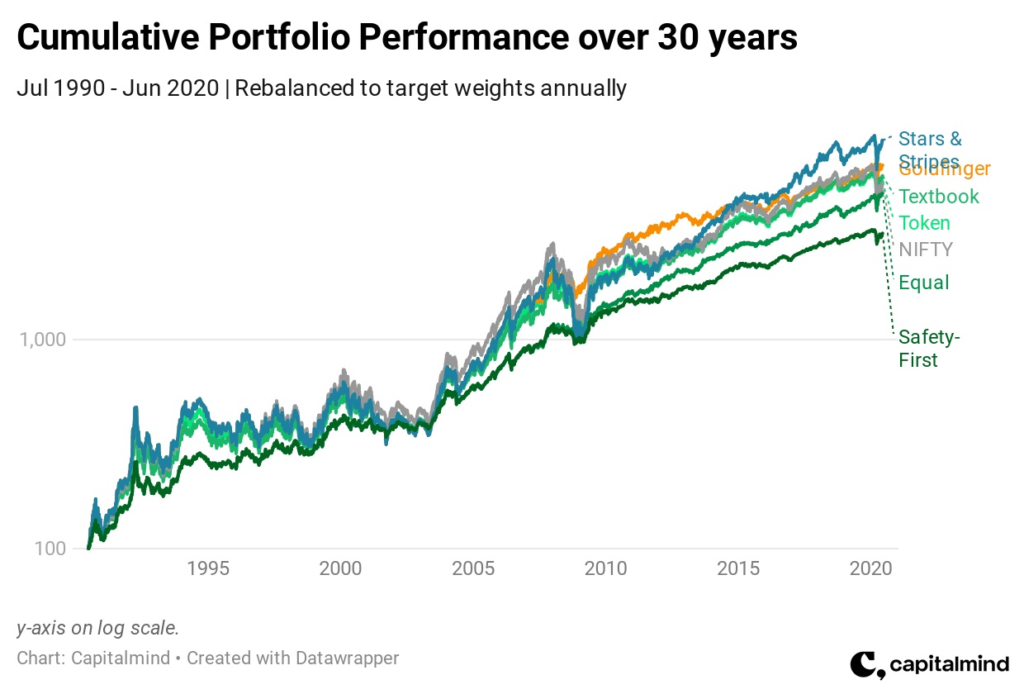

Portfolio Performance Over 30 Years

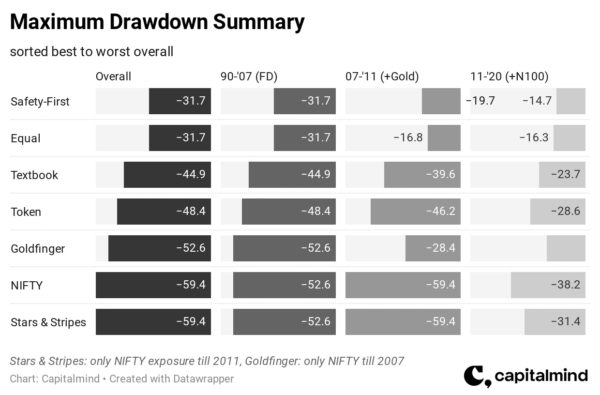

A long-term performance evaluation of these strategies provides key insights:

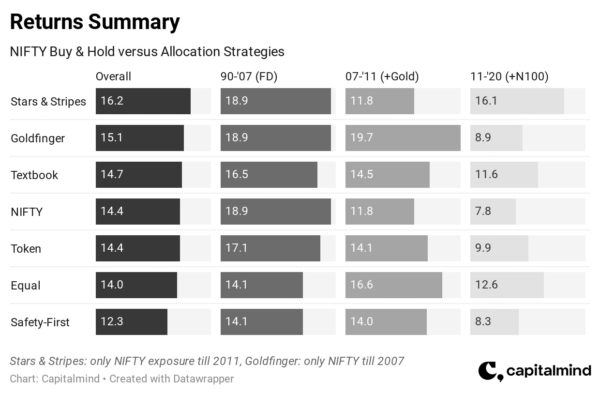

- Portfolios with exposure to multiple asset classes (TextBook, Token, Equal-Weight) delivered competitive returns with lower volatility compared to an all-equity Nifty-Only portfolio.

- The Goldfinger and Stars & Stripes strategies, which allocate 50% to either Gold or US Equities, showed strong performance, often outperforming the Nifty-Only portfolio.

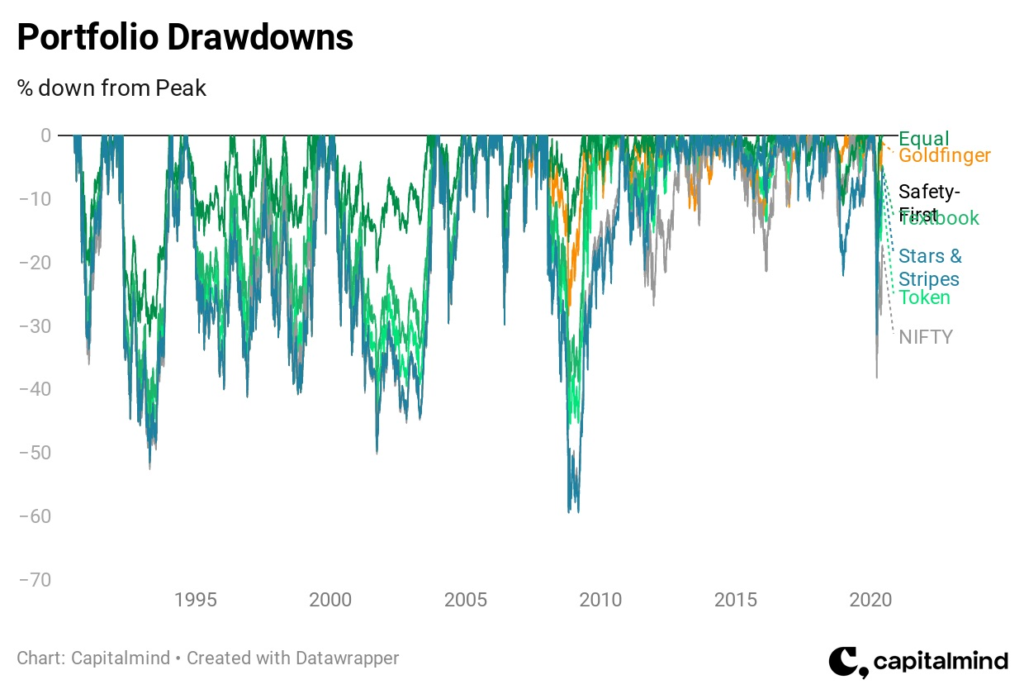

- The Equal-Weight and Safety-First portfolios had the lowest volatility and the smallest drawdowns, making them ideal for conservative investors.

- The Nifty-Only strategy exhibited the highest volatility and deepest drawdowns, indicating that diversification helps in risk reduction without compromising returns.

Key Takeaways

- Diversification is Essential: The Nifty-Only strategy carried excessive risk without offering a commensurate increase in returns. Allocating across asset classes helps in achieving stability and consistency.

- Balanced Approaches Perform Well: The TextBook and Token allocations provided near-Nifty-like returns but with lower drawdowns and volatility.

- International Exposure Matters: The Stars & Stripes portfolio showed that allocating to US Equities improves returns while providing geographical diversification.

- Gold Acts as a Hedge: Gold provided downside protection during market downturns, making it a useful component in asset allocation.

The Ideal Asset Allocation for Indian Investors

While there is no universally perfect asset allocation, a TextBook-style portfolio (50% Domestic Equities, 20% Debt, 10% Gold, 20% US Equities) strikes an optimal balance between growth, stability, and diversification. It delivers strong returns with significantly lower volatility than an all-equity approach.

For investors with a higher risk tolerance and a long-term horizon, increasing exposure to international equities (Stars & Stripes variation) can be beneficial. On the other hand, conservative investors who prioritize stability may prefer the Safety-First or Equal-Weight approach.

Final Thoughts

The best asset allocation strategy is the one that allows you to stay invested consistently without feeling the urge to exit during market downturns. Once you’ve decided on your ideal allocation, the key is to invest in low-cost index funds, Sovereign Gold Bonds for gold exposure, and fixed-income instruments for debt. Rebalancing annually ensures your portfolio remains aligned with your financial goals.

By focusing on asset allocation rather than chasing individual stocks or market trends, investors can build a robust and resilient portfolio that stands the test of time. Ultimately, the best strategy is the one you can stick to for the long haul.

Courtesy : Capital Minds

Support this community : FabTrader.in is a one-person initiative dedicated to helping individuals on their F.I.R.E. journey. Running and maintaining this community takes time, effort, and resources. If you’ve found value in the content, consider making a donation to support this mission.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.