Understanding Home Loan Interest Zeroisation

Paying interest on a home loan can feel like a burden, but what if you could offset it entirely? Home loan interest zeroisation is a strategic approach that helps neutralize the total interest paid over the loan’s tenure by investing wisely. Instead of simply paying off your loan, this method allows you to build an investment portfolio that generates returns equivalent to the interest cost.

How Does It Work?

The idea is straightforward—set up a parallel investment plan that grows over time and matches the interest you pay on your home loan. By systematically investing in the right financial instruments, you can ensure that the returns from your investments will eventually cover the interest expense, effectively making the loan interest-free.

Key Steps to Implement This Strategy

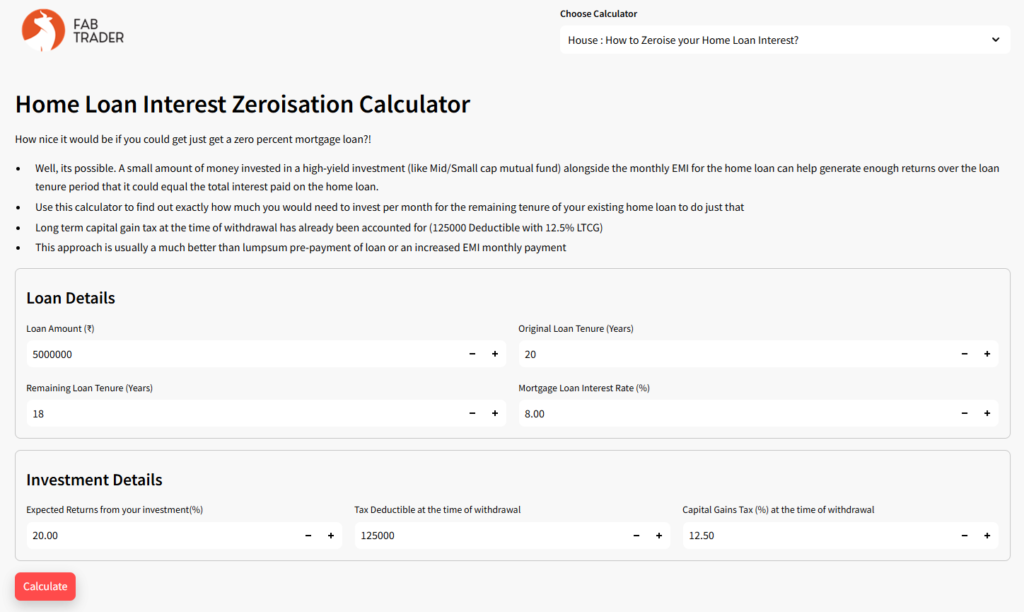

Step 1: Calculate the Investment Needed

To make this strategy work, you first need to determine the amount you’ll be paying as interest over the remaining tenure of your loan. Once you have this figure, you can calculate how much you need to invest every month to generate the required returns. The goal is to ensure that the investment growth matches the total loan interest.

Step 2: Choose the Right Investment Instruments

Not all investments are suitable for this approach. The key is to select options that offer consistent and predictable returns. Some ideal investment choices include mutual funds, debt funds, and fixed-income securities. The expected return on investment should be realistic and align with your risk tolerance and financial goals.

Step 3: Factor in Tax Implications

One important aspect of this strategy is tax planning. The investment returns are subject to taxation, so you must plan accordingly to maximize your net returns.

- Any returns up to ₹1,25,000 are tax-free.

- Beyond this threshold, a 12.5% long-term capital gains tax applies.

- Understanding and optimizing the tax impact ensures you achieve the desired outcome.

Benefits of Home Loan Interest Zeroisation

This approach provides several financial advantages:

- Offsets the entire interest paid on the loan.

- Helps build wealth while repaying the loan.

- Reduces overall financial burden and outflow.

- Offers flexibility in managing personal finances.

Step-by-Step Implementation

- Analyze your current home loan details, including the outstanding tenure and interest.

- Calculate the monthly investment required to neutralize the interest expense.

- Select investment instruments that align with your expected returns.

- Set up an automated monthly investment plan.

- Monitor and rebalance the investment portfolio periodically to ensure it remains on track.

Challenges to Consider

While this strategy is powerful, it does come with some challenges:

- It requires strict financial discipline to ensure consistent investments.

- Market fluctuations can impact investment returns, requiring periodic adjustments.

- Professional financial guidance may be necessary to execute the plan effectively.

Final Thoughts

Home loan interest zeroisation is a smart and strategic approach to mortgage management. By leveraging the power of investing, you can turn what seems like an unavoidable expense into a wealth-building opportunity. However, it requires careful planning, consistent execution, and periodic monitoring to be successful. If done right, this strategy can significantly improve your financial well-being and help you achieve financial freedom faster.

Disclaimer: This strategy depends on various factors, including market conditions and personal financial goals. It is advisable to consult a financial expert before making any investment decisions.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.