When managing your finances, one of the biggest dilemmas homeowners face is whether to prepay their home loan or invest their extra funds. This decision becomes even more complex when tax savings come into play. Our new Home Loan Prepayment vs Investment Calculator helps you make a well-informed choice by calculating the effective home loan interest rate after tax benefits. If you can invest in an instrument that offers returns higher than this effective rate, investing might be the better option. Otherwise, prepaying your loan could save you more money in the long run.

Access Home Loan Prepayment Vs Invest Calculator

Understanding the Tax Benefits on Home Loans in India

The Indian government provides tax deductions that reduce the effective cost of borrowing:

- Section 80C: Deduction of up to ₹1.5 lakh per year on the principal repayment of a home loan.

- Section 24(b): Deduction of up to ₹2 lakh per year on interest paid for a self-occupied home loan. If you have a co-borrower, this limit applies to both borrowers individually.

How the Calculator Works

Our calculator applies the tax savings to the home loan to determine the effective interest rate. This rate helps you compare whether investing is a better alternative to prepaying your loan.

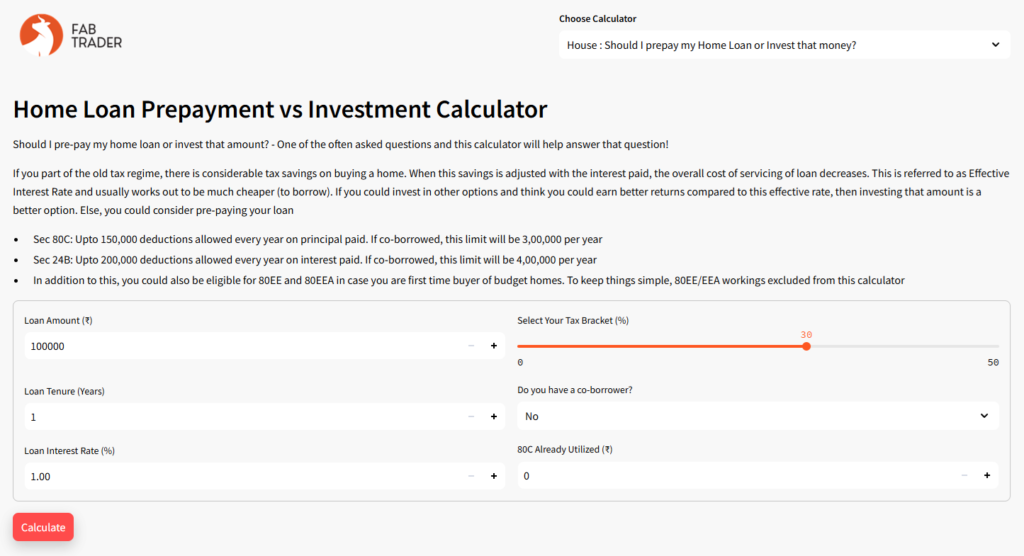

Inputs Required

- Loan Amount: The total amount borrowed.

- Loan Tenure: The number of years for loan repayment.

- Loan Interest Rate: The interest rate applicable to your loan.

- Tax Bracket: Your applicable income tax bracket (5% to 30%).

- Co-Borrower Status: Whether you have a co-borrower to increase tax benefits.

- 80C Utilization: How much of your ₹1.5 lakh limit under Section 80C is already used for other investments (e.g., PPF, ELSS, etc.).

How We Calculate the Effective Interest Rate

- Break down EMI into principal and interest components.

- Accumulate principal and interest payments annually.

- Apply tax benefits at the end of each year:

- Adjust for 80C deductions on principal repayment.

- Adjust for 24(b) deductions on interest paid.

- Calculate monthly cash flows after applying tax savings.

- Compute the effective interest rate using IRR (Internal Rate of Return) to determine the true cost of the home loan.

Making the Right Decision: Prepay or Invest?

Once you obtain the effective home loan interest rate, you can compare it with potential investment returns:

- If you have an investment opportunity that offers a return higher than the effective rate, investing is a better option.

- If your effective home loan interest rate is still high, prepaying your home loan might be the best choice.

Final Thoughts

This calculator provides an accurate and tax-adjusted view of your home loan’s actual cost, helping you make a financially sound decision. By factoring in tax benefits, you can make a more informed choice between prepaying your home loan or investing your surplus funds.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The content is based on publicly available information and personal opinions and may not be suitable for all investors. Investing involves risks, including the loss of principal. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author and website assume no liability for any financial losses or decisions made based on the information presented.